This article provides a summary of a recent discussion on data monetization featuring Enveil CEO Ellison Anne Williams, where topics included the privacy obligations institutions have in regard to using consumers data and the technology that can help protect it.

Excerpt from the summary of the panel discussion:

Ellison Anne Williams continued to explain what opportunities monetisation can bring to organisations revolving around creating new revenue streams from data resources or assets, something that has been increasingly seen during the difficulties of the Covid-19 pandemic. “In terms of revenue, it can either manifest as a data as a service type of offering, where you allow different customers to run searches and analytics over your data holdings, or as some kind of derivative product that’s offered and sold based on those data resources,” she said. “What’s not a huge opportunity in data monetisation is selling data in bulk as that has a whole different set of privacy regulations and obligations associated with it.”

Williams further explained that opportunities specifically for banks depend on the type of data that’s available to be potentially monetised. “It’s not only the customer-related data and the classic kind of data that you think of when talking monetisation, but you can also look at greatly monetising and creating revenue streams, which are never more important than in a time like Covid, from things like transaction data and other types of metadata about what’s going on within the financial services institution.”

[...]

The panel went on to discuss what banks can do to protect consumer data, and it was repeated as to how important transparency is when it comes to data. “Trust and transparency are key, obtaining and maintaining consumer trust on how you are handling and respecting the data that they are entrusted with by virtue of doing business is very important,” said Williams.

According to her, there are two considerations that have to be looked at from a privacy standpoint. One is the underlying data itself which will be the subject of the monetisation, i.e. customer-related data, transaction data or metadata etc. There are going to be privacy obligations associated with that data, and Williams stressed how it needs to be understood and respected during the monetisation process. The second privacy aspect to consider is the users of the monetisation data service or product itself. For example, if you have a data as a service offering, where you allow customers to search or analyse data assets or resources, you have to carefully consider what the privacy responsibilities are associated with those customers and their footprint while they are leveraging that data.

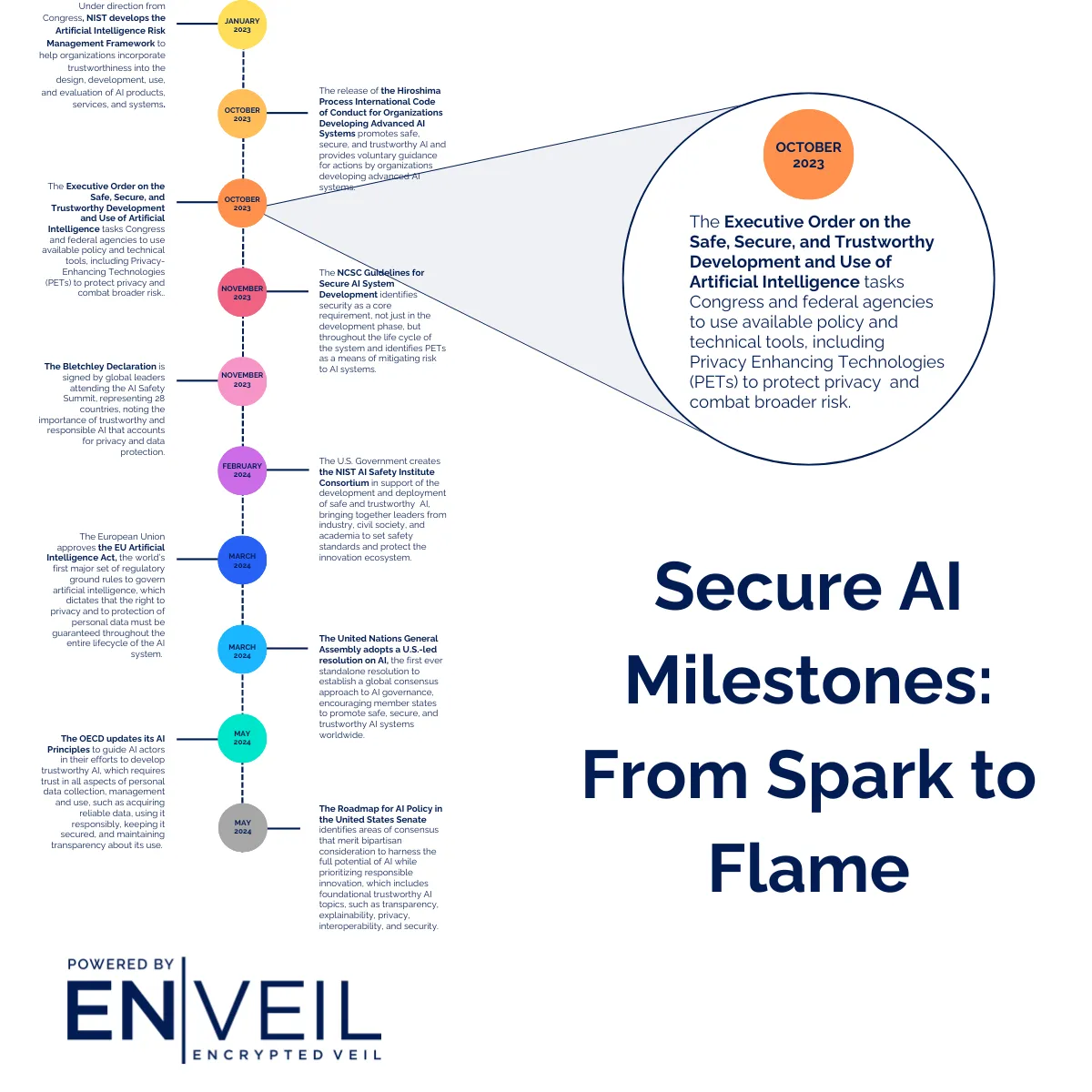

“The good news is that there are many technologies revolving around the respect and preservation of privacy,” said Williams. “There is a business-enabling family of technologies called ‘privacy enhancing technologies’ that allows both of those categories, the underlying data itself as well as the users of the monetisation platform or service to be uniquely respected.”

Read the full recap at The FinTech Times.